When it comes to managing finances in the United States, one of the most important responsibilities every individual and business owner has is tax filing. Whether you’re a U.S. citizen, permanent resident, freelancer, or small business owner, filing your taxes accurately and on time is essential.

If you find the process confusing or time-consuming, a professional US tax filing service can make the whole experience simple, accurate, and worry-free. Let’s explore everything you need to know about it.

What Is a US Tax Filing Service?

A tax filing service helps individuals and businesses prepare and file their taxes according to IRS regulations. These services are handled by tax professionals who understand the complex U.S. tax laws and ensure your tax return is accurate and compliant.

You can think of it as your personal tax assistant — making sure you pay the right amount, get all eligible deductions, and never miss a deadline.

Who Needs to File Taxes in the U.S.?

You are required to file a U.S. tax return if you fall under any of these categories:

- U.S. citizens and residents earning income from any source

- Non-residents with income generated in the U.S.

- Self-employed individuals or freelancers who earn more than $400 annually

- Small business owners or partners in a registered business

- Foreign students or expatriates working or studying in the U.S.

Simply put, if you’re earning money in the United States — directly or indirectly — you likely need to file taxes.

Benefits of Using a Professional Tax Filing Service

Filing taxes can feel overwhelming, especially with ever-changing tax laws and dozens of forms to understand. Here’s why hiring professionals makes a big difference:

Saves Time and Stress – No more late nights figuring out tax codes.

Ensures Accuracy – Professionals check every detail to avoid costly errors.

Maximizes Refunds – Expert knowledge means you get every possible deduction.

Avoids Penalties – You stay fully compliant with IRS deadlines and regulations.

Protects Against Audits – Get peace of mind with documentation prepared properly.

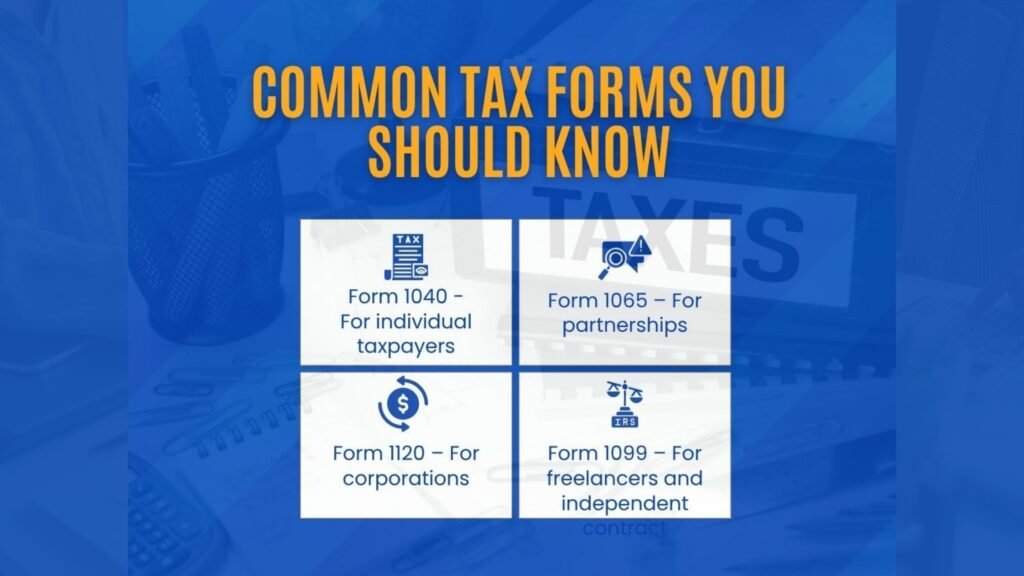

Common Tax Forms You Should Know

Here are the most frequently used IRS forms for U.S. tax filing:

- Form 1040 – For individual taxpayers

- Form 1065 – For partnerships

- Form 1120 – For corporation

- Form 1099 – For freelancers and independent contractors

Each form has a specific purpose, and using the wrong one can delay your refund or cause penalties — another reason why professional help matters.

Step-by-Step Process of Filing U.S. Taxes

Filing taxes through a professional service usually involves these simple steps:

- Gather Documents – Collect income statements, expenses, W-2s, and 1099s.

- Calculate Income & Deductions – Identify all sources of income and eligible deductions.

- Choose the Right Forms – Depending on your employment or business type.

- Prepare & Review – Ensure all information is accurate and verified.

- Submit to IRS – File electronically or via mail.

- Receive Refund or Pay Balance – Depending on your final tax calculation.

With professional assistance, this process becomes quick, organized, and error-free.

Common Tax Filing Mistakes to Avoid

Even small mistakes can lead to big financial issues. Watch out for these:

- Using the wrong tax form

- Forgetting to include all income sources

- Claiming incorrect deductions

- Late filing or missing IRS deadlines

- Entering wrong Social Security numbers

Professional tax preparers double-check every step to ensure your return is 100% accurate.

Why Choose Our US Tax Filing Service

Our US Tax Filing Service is designed to make tax season stress-free. Here’s what sets us apart:

- Certified tax professionals with years of experience

- Affordable packages for individuals and businesses

- Online, hassle-free filing from anywhere

- Data security guaranteed

- Fast processing and maximum refund assurance

Whether you’re an individual, freelancer, or small business owner, we ensure your taxes are filed correctly — every single time.

Frequently Asked Questions (FAQs)

1. How much does it cost to file taxes in the U.S.?

It depends on your income type and filing complexity. Simple returns may cost less, while business filings or multiple forms may require a higher fee.

2. When is the U.S. tax filing deadline?

Usually, the deadline is April 15th each year. Extensions are available upon request.

3. Is online tax filing safe?

Yes, as long as you use a secure and certified service provider. We use encryption and data protection to keep your information safe.

4. How long does it take to get a refund?

Generally, refunds arrive within 2–3 weeks if filed electronically and with direct deposit.

Conclusion

Filing your U.S. taxes doesn’t have to be stressful or confusing. With the right US Tax Filing Service, you can save time, avoid penalties, and ensure you get the maximum refund possible.